Bank of Montreal

A Conversational Assistant Experience

Client

BMO, Toronto 🇨🇦

(Working remotely as a contract Product Designer, with a team of 3: 1 Designer, 1 Content Strategist and 1 Product Manager.)

Platform

iOS, Android

Background

The Bank of Montreal (BMO) is a Canadian multinational investment bank and financial services company. BMO serves more than 12 million customers through three integrated operating groups providing personal and commercial banking, wealth management and investment services.

BMO has always been at the forefront of innovation. It launched the first ATMs in Canada, was one of the earliest Internet banks on the scene, and launched the first robo-advisor product in Canada. Since then, BMO has also invested heavily in digital as part of its commitment to reimagining banking by creating highly personalized, relevant, and accessible customer experiences. In fact, BMO’s vision is to be the bank that defines the great customer experience.

Goal

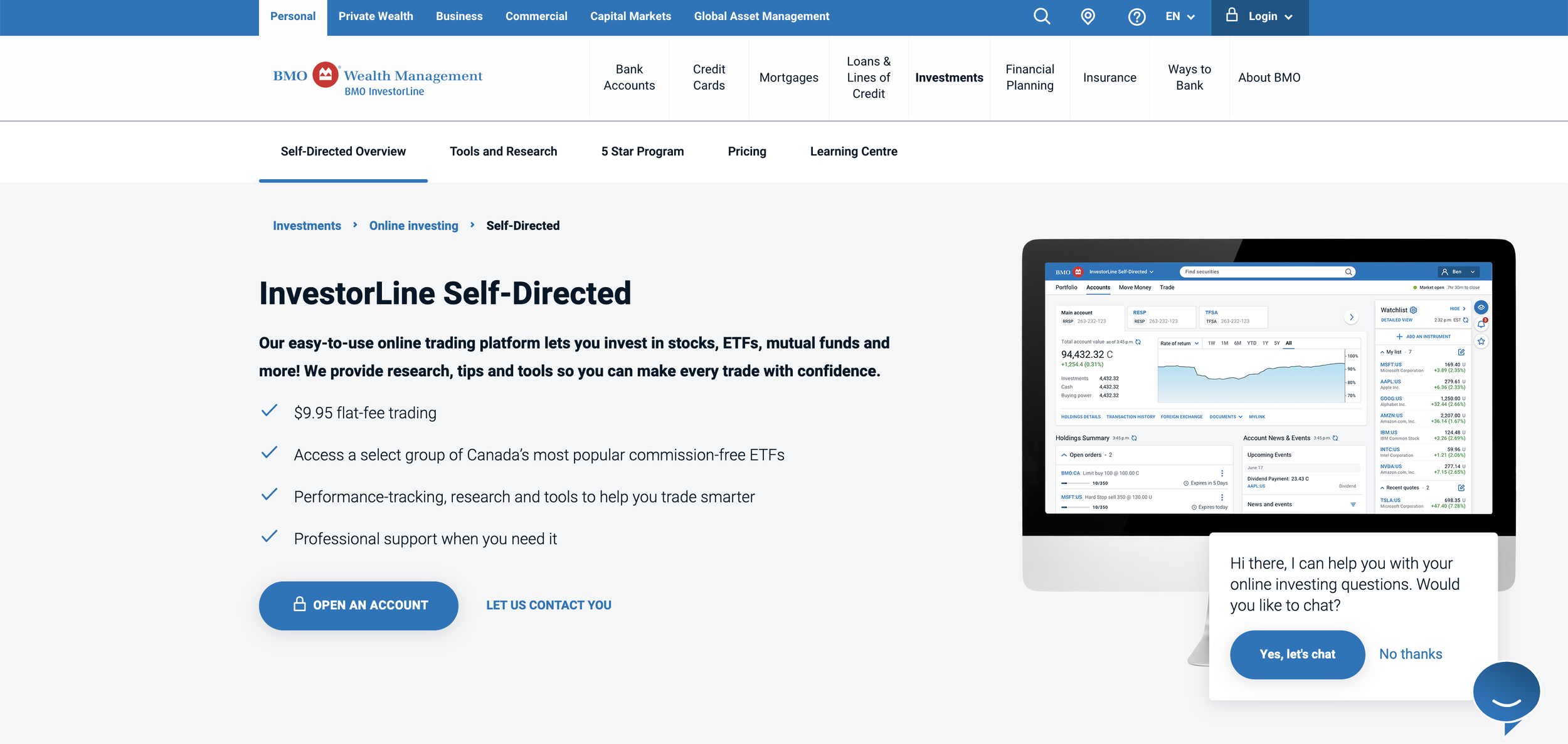

BMO’s InvestorLine Self-Directed allows users to invest in stocks, ETFs, mutual funds and more! Investorline Self-Directed provides research, tips and tools so users can make every trade with confidence. My role was to design a conversational banking assistant to help new and existing investors find answers to investing-related questions.

Outcome

We streamlined and built an intuitive conversational assistant that enables new and existing users to self-serve on actions such as creating a new account, choosing the right trading platform, and much more.

“By giving our prospects and customers the opportunity to engage with our brand, access information, and explore our products, we wanted to be able to not only create better experiences for them, but also lay the foundation for more personalized customer service and sales capabilities in the future.”

Defining Tone and Voice

Based on user research, we know that 66% of users try to use self-service first before using other means of contact. This is a high percentage of customers engaging with our conversational assistants. To minimize frustration and build trust, we interviewed users to understand their expectations and needs.

Based on insights from user interviews, and user expectations, I worked with the Content Strategist to design the conversational assistant with an appropriate personality.

How It Works

Results

We gathered insights on user satisfaction through success surveys at the end of the interaction with the conversational assistant. When users reached the end of a conversation with our conversational assistant, they were presented with a simple survey question so we could know if the information was satisfactory or not. Early results were promising- allowing us to continue to expand on the ways in which our conversational assistants can help users with their everyday banking needs.

“We knew that launching a conversational assistant would change the way we work as a company and as a brand by fundamentally shifting how we engage with current and prospective customers.”